Business Valuation Services

What is your business worth today?

How quickly can you realistically sell your business?

What can you do to increase the value by 20-50%?

What are the values drivers you should focus on today to increase the business's value?

Business Valuation Options:

What Is Your Business Worth?

Most business owners only sell one business in their lifetime, and normally, it is the business they have spent their lifetime growing and shaping. If you're a business owner in the Tampa Bay area—whether you're running a thriving operation in Tampa, St. Petersburg, Sarasota, Clearwater, or throughout Florida and United States—when it comes time for you to look at moving on to the next step in your life, you likely have the same question: "How or where do I begin?"

The first step when considering selling your business is to determine the value of your business. Edison Avenue can provide you with a detailed and custom Opinion of Value report giving you an objective price range you can expect to receive from the marketplace—one that reflects the unique dynamics of the Tampa Bay business landscape. The managing partner of Edison Avenue wrote the highly popular book on exit planning, "Exit Like A Winner," which is available on Amazon and Audible.

Why Business Valuation Matters

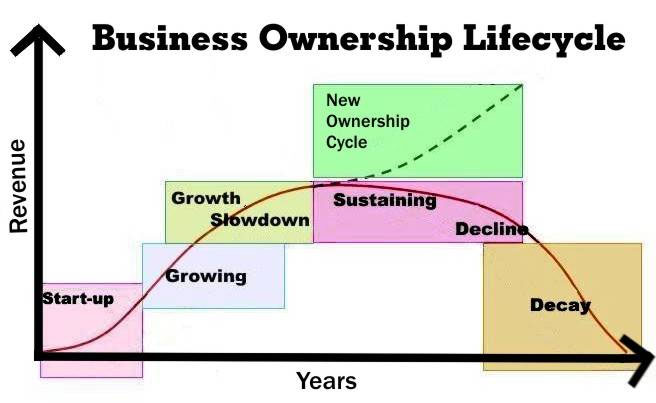

A IBBA (International Business Broker Association) study indicated that 75% of business owners don't know how much their business is actually worth. In the Tampa Bay area, where the business market is competitive and diverse, this knowledge gap can be costly. Too many business owners are forced to sell because of an unexpected event or crisis and do not receive the optimal price and terms. The best way to avoid this fate is to develop a comprehensive exit plan well in advance, understand the present market value of your business within the Tampa Bay region, implement growth strategies that increase the business value, and sell your business when the timing is right—not when a crisis strikes.

Think of a business valuation service as the "blood pressure check" to make sure your business is on track to deliver the net worth you will need to exit successfully.

How We Determine Your Business Value

Financial Documentation Review

In order to complete the business valuation, our M&A advisor will need financial documentation of the business's history and current financial trending. These include 3-5 years of tax returns and financials, year-to-date financials, equipment lists, lease agreements, and a deep understanding of your business model. Whether your business is located in downtown Tampa, the Westshore business district, Sarasota's thriving entrepreneurial community, or any other part of the Tampa Bay region, we apply the same rigorous financial analysis.

Recasting Your Financials

Edison Avenue will recast your financials to show your business's actual financial performance and income-generating ability—known as Owner Benefit or Sellers Discretionary Earnings (SDE). This is needed since your profits on financial statements and tax returns are usually minimized to decrease the amount of your business's income taxes. In addition, Edison Avenue's M&A Advisor will have access to a vast amount of historical data for similar businesses that have actually sold in the Tampa Bay market and beyond. This is much more reliable than the stories of 10X EBITDA or rule of thumb told by someone at the last social event you attended.

Identifying Discretionary Expenses

While examining these documents, the M&A advisor will ask a series of questions to help you determine which of the expenses may have been unnecessary, non-discretionary, or one-time/nonrecurring. These are expenses the new owner would not have and could be added to the true discretionary cash flow. In the Tampa Bay business environment, this might include owner perks, non-essential staffing, or one-time capital expenditures specific to your situation.

Key Value Drivers Beyond the Numbers

Besides your business financials, there are other factors that are examined in determining your business's value. These include location, competition, regional demand factors, lease terms, type of buyer, supplier relationships, scalability of business model, profit margins, customer revenue concentration, and recurring revenue.

For businesses in the Tampa Bay area specifically, location within our region matters significantly. A business in Sarasota's growing downtown corridor may command different multiples than an equivalent business in Clearwater or Lutz. Similarly, the competitive landscape varies—some industries are saturated in certain Tampa Bay neighborhoods, while others face less direct competition. Understanding how your specific location within the Tampa Bay market impacts your valuation is crucial.

The Role of Cash Flow in Valuation

The greatest factor in the valuation is often the quantity and reliability of the cash flow your business has generated. Buyers—whether they're local entrepreneurs looking to acquire a Tampa Bay business or regional/national firms expanding into Florida—will most often formulate their purchase price based upon the historical financial performance. However, the reason for their acquisition is the future potential they see in your business. In the Tampa Bay market, where diverse industries and strong economic fundamentals attract buyers from across the country, demonstrating consistent and growing cash flow is your strongest selling point.

Understanding the Tampa Bay Business Market

The Tampa Bay region has experienced significant economic growth over the past decade, attracting both local and out-of-state buyers. Businesses in our area benefit from a robust economy, strategic geographic location, and access to multiple ports and transportation hubs. However, this growth also means increased competition for acquisition opportunities. Understanding how your business positions itself within this dynamic market is essential to maximizing your exit value.

Buyers acquiring businesses in the Tampa Bay area often cite the region's business-friendly environment, skilled workforce, and growth trajectory as key factors in their acquisition decisions. If your business can demonstrate alignment with these regional strengths—whether through operational efficiency, employee retention, customer loyalty, or market positioning—it becomes significantly more attractive to potential buyers. TIP: Don't settle for a business broker in Tampa, insist on an M&A Advisor for next-level professionalism.

Developing Your Exit Strategy

The difference between a successful exit and a missed opportunity often comes down to timing and preparation. Business owners in Tampa, St. Petersburg, Sarasota, Clearwater, and throughout the surrounding 50-mile area who begin their exit planning process early are better positioned to optimize their sale price and terms.

Your business valuation is the first critical step. It answers the fundamental question: "What is my business worth in today's Tampa Bay market?" From there, we can work with you to identify areas for improvement, develop a strategic timeline for your exit, and help you navigate the competitive landscape of selling a mid-market business in our region.

Depending upon your need we provide two different levels of business valuation services:

- Opinion of Value Report – Most Popular (Comprehensive 24+ page report utilizing multiple valuation methodologies with supporting evidence) Learn what price your competitors are actually selling their businesses for. You also learn whether or not that price you think it's worth is fair and reasonable. Will you have enough money to retire? Find out now while you have time to increase the value of your business with our top 5 recommendations tailored to your company.

- Certified Business Valuation (Stock Sale, Divorce, Legal Matters, IRS) We can provide these to you when that level of supporting detail is required due to the legal disputes or bank requirements. These cost two to three times as much as an Opinion of Value report.

Understanding the present market value of your business is the very first step in helping you decide whether you should sell your business and if so what is a fair price.

Disclaimer: An Opinion of Value report is not appropriate for legal disputes, divorces, bank loans, or any legal matter. In this case, you will need a Certified Business Valuation, which we can also provide, and you'll need to call us for a price quote.

Call today for a complimentary and no obligation initial discussion.